7 Ways to Protect Against Wire Transfer Fraud

With Cybersecurity Awareness Month here, we’re ready to help.

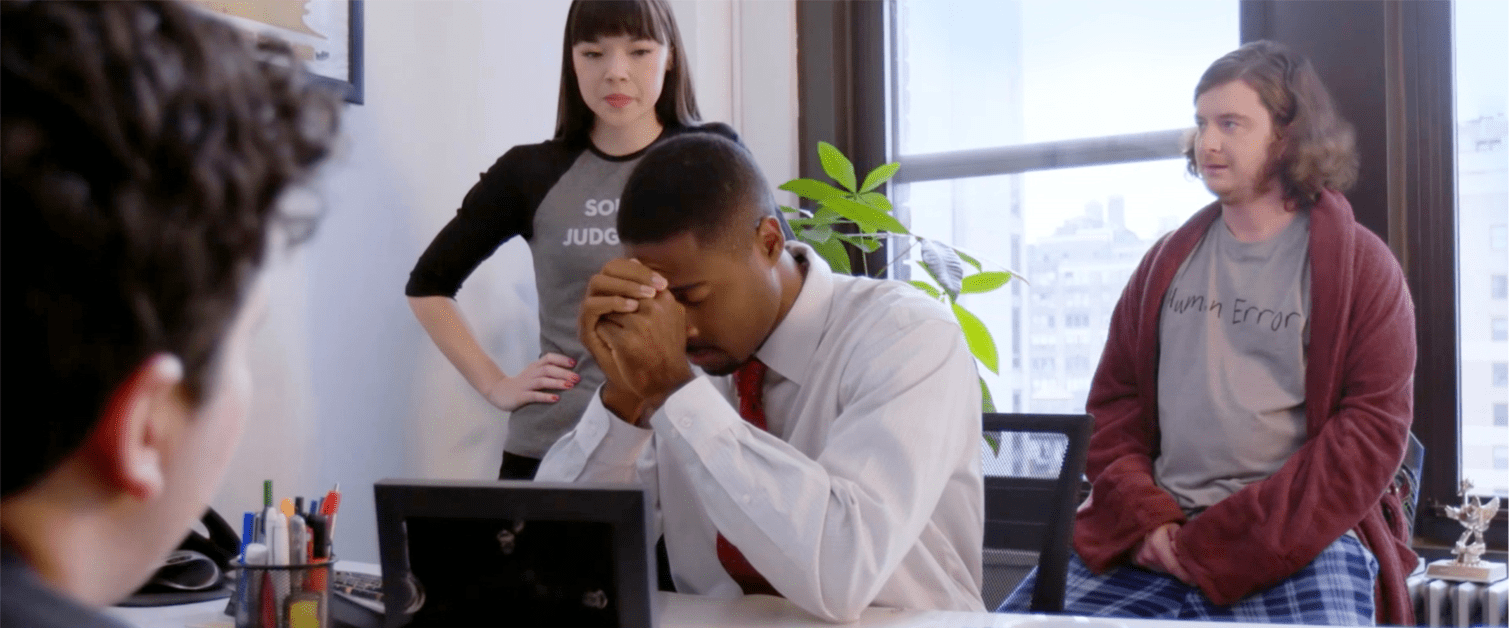

Human error is one of the leading barriers to effective cybersecurity. Casual security mistakes can lead to career-threatening results. Putting the right technology in place to improve your cybersecurity is important. However, an educated workforce that’s aware of the threats and knows how to prevent them is the last piece of the puzzle.

You can teach employees what they need to know to keep your organization secure, and we’re here to help.

As part of Cybersecurity Awareness Month in October, we’re bringing you a weekly series on common threats to strengthen your cyber resilience strategy.

This week, we’re tackling the issue of how to avoid wire transfer fraud. You can learn about other similar threats—and how to prevent wire transfer fraud by downloading our cybersecurity awareness training kit.

What you Should Know about Wire Transfer Fraud

Reports of wire transfer fraud have soared from 14% of companies (2014) to 48% (2017).* Cybercriminals trick individuals into initiating fraudulent payments or providing information they can use to steal directly from company accounts. Wire payments are executed by the financial institution almost instantly.

They can be impossible to reverse.

Criminals have become sophisticated about impersonating staff members to make urgent requests seem legitimate. For example, they’ve started linking wire scams to tax requirements, and using domestic accounts rather than more suspicious international accounts. Today, employees need to be more careful.

How to Protect Against Wire Transfer Fraud

- Always follow the company’s processes for authenticating payment requests and making payments.

- Check personally with your manager or vendor before responding to any unexpected request for a wire transfer or other payment.

- Be suspicious of urgent requests and ones that are made at a time when it may be harder to confirm them.

- Carefully confirm any requested changes to a vendor’s payment location.

- Don’t be tricked by calls or emails, claiming to be from the IRS or other tax authorities, that demand immediate wire transfer payments.

- Avoid posting information on social media that might be used by fraudsters to impersonate you (for example, information about your travel plans).

- Contact company security immediately if you suspect someone is trying to commit wire transfer fraud.

*2018 AFP® Payments Fraud and Control Survey Report, Association for Financial Professionals, 2018.

Subscribe to our blog to keep up to date with the latest cybersecurity news, information, tips and analysis.

Subscribe to Cyber Resilience Insights for more articles like these

Get all the latest news and cybersecurity industry analysis delivered right to your inbox

Sign up successful

Thank you for signing up to receive updates from our blog

We will be in touch!