7 Wege zum Schutz vor Überweisungsbetrug

Der Monat der Cybersicherheit steht vor der Tür und wir sind bereit zu helfen.

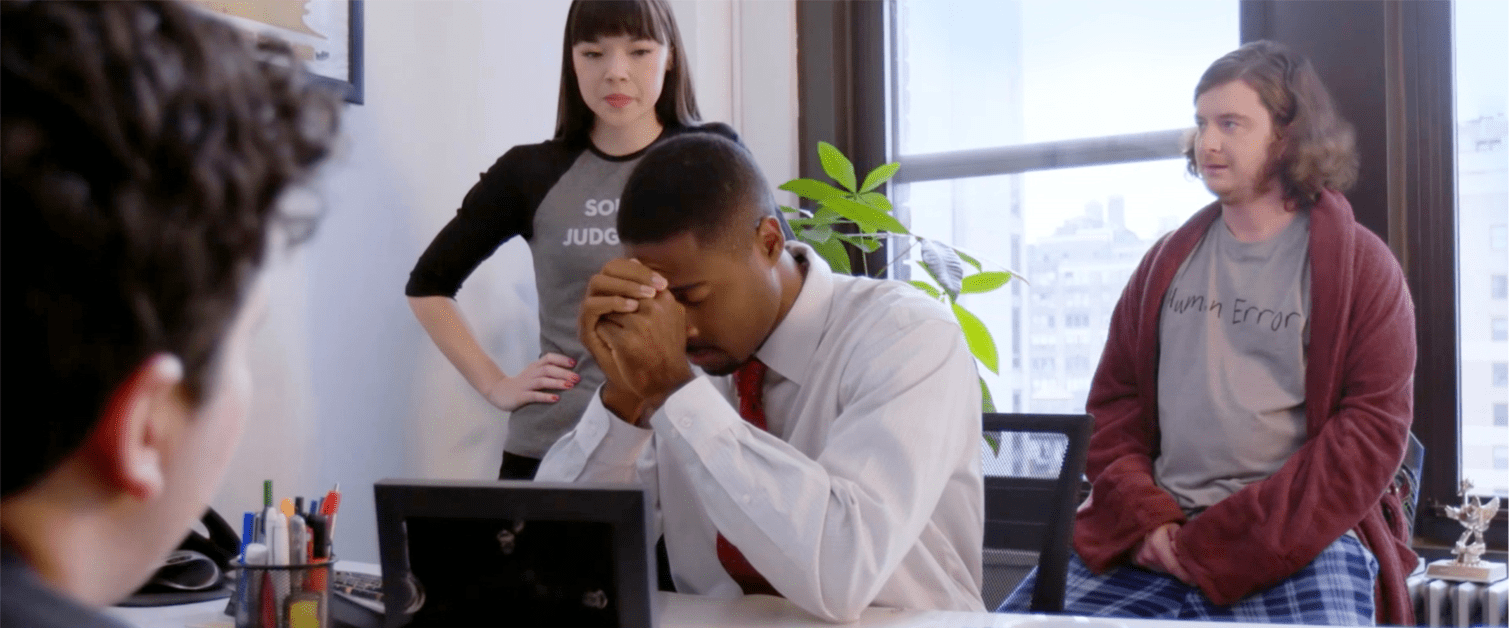

Menschliches Versagen ist eines der größten Hindernisse für eine wirksame Cybersicherheit. Gelegentliche Sicherheitsfehler können zu karrieregefährdenden Ergebnissen führen. Es ist wichtig, die richtige Technologie einzusetzen, um Ihre Cybersicherheit zu verbessern. Das letzte Puzzleteil ist jedoch eine gut ausgebildete Belegschaft, die sich der Bedrohungen bewusst ist und weiß, wie man sie verhindern kann.

Sie können Ihren Mitarbeitern beibringen, was sie wissen müssen, um die Sicherheit Ihres Unternehmens zu gewährleisten, und wir helfen Ihnen dabei.

Im Rahmen des Cybersecurity Awareness Month im Oktober bieten wir Ihnen eine wöchentliche Serie über häufige Bedrohungen zur Stärkung Ihrer Cyber-Resilienz-Strategie.

Diese Woche befassen wir uns mit dem Thema , wie man Überweisungsbetrug vermeiden kann. Sie können sich über andere ähnliche Bedrohungen informieren - und darüber, wie Sie Überweisungsbetrug verhindern können, indem Sie unser Schulungspaket zur Cybersicherheit herunterladen.

Was Sie über Überweisungsbetrug wissen sollten

Berichte über Überweisungsbetrug sind von 14 % der Unternehmen (2014) auf 48 % (2017) angestiegen.* Cyberkriminelle verleiten Einzelpersonen dazu, betrügerische Zahlungen zu veranlassen oder Informationen bereitzustellen, mit denen sie direkt von Unternehmenskonten stehlen können. Überweisungen werden von den Finanzinstituten fast sofort ausgeführt.

Es kann unmöglich sein, sie rückgängig zu machen.

Die Kriminellen haben es verstanden, sich als Mitarbeiter auszugeben, um dringende Anfragen als legitim erscheinen zu lassen. So haben sie beispielsweise begonnen, den Überweisungsbetrug mit steuerlichen Anforderungen zu verknüpfen und inländische Konten anstelle der verdächtigeren internationalen Konten zu verwenden. Heutzutage müssen die Mitarbeiter vorsichtiger sein.

Wie man sich vor Überweisungsbetrug schützen kann

- Befolgen Sie stets die Verfahren des Unternehmens zur Authentifizierung von Zahlungsanträgen und zur Durchführung von Zahlungen.

- Erkundigen Sie sich persönlich bei Ihrem Vorgesetzten oder Verkäufer, bevor Sie auf eine unerwartete Anfrage für eine Überweisung oder eine andere Zahlung reagieren.

- Seien Sie misstrauisch bei dringenden Anfragen und solchen, die zu einem Zeitpunkt gestellt werden, zu dem es schwieriger sein könnte, sie zu bestätigen.

- Bestätigen Sie sorgfältig alle gewünschten Änderungen am Zahlungsort eines Lieferanten.

- Lassen Sie sich nicht von Anrufen oder E-Mails täuschen, die vorgeben, von der IRS oder anderen Steuerbehörden zu kommen, und in denen sofortige Überweisungen gefordert werden.

- Vermeiden Sie es, Informationen in sozialen Medien zu veröffentlichen, die von Betrügern dazu benutzt werden könnten, sich als Sie auszugeben (z. B. Informationen über Ihre Reisepläne).

- Wenden Sie sich sofort an den Sicherheitsdienst Ihres Unternehmens, wenn Sie den Verdacht haben, dass jemand versucht, Überweisungsbetrug zu begehen.

*2018 AFP® Payments Fraud and Control Survey Report, Association for Financial Professionals, 2018.

Abonnieren Sie unseren Blog , um über die neuesten Nachrichten, Informationen, Tipps und Analysen zur Cybersicherheit auf dem Laufenden zu bleiben.

Abonnieren Sie Cyber Resilience Insights für weitere Artikel wie diesen

Erhalten Sie die neuesten Nachrichten und Analysen aus der Cybersicherheitsbranche direkt in Ihren Posteingang

Anmeldung erfolgreich

Vielen Dank, dass Sie sich für den Erhalt von Updates aus unserem Blog angemeldet haben

Wir bleiben in Kontakt!